FinTech has transformed the industry of financial services and has become a multi-billion dollar quarter in the process. However, with an increasing reputation over time, FinTech app development costs are also evolving.

FinTech applications enable seamless financial transactions, advance personalized financial services, and enhance user experience. As we are moving into the middle of 2024 and progressing towards 2025, the demand for refined FinTech solutions persists to grow, driven by developments in technology and transforming consumer intentions.If you are intending to create a FinTech app for your business, then it is the most suitable time to do so. Let’s comprehend all that you ought to learn about FinTech app development costs in 2024 and beyond.

FinTech and its Importance

FinTech is entirely the use of technology in order to provide financial services in more affordable, efficient, and innovative methods. It encloses a surfeit of applications such as digital payments, mobile banking, wealth management tools, cryptocurrency dealings, etc.

Well, the year 2024 marks a climactic movement for FinTech with elongated adoption and incorporation of digital financial services into day-to-day lives. Users endure for convenience, personalized experiences, and security that is delivered by FinTech apps, hence it has become the cornerstone of contemporary financial services and interchanges.

Numerous key trends influence FinTech app development in 2024 such as Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, blockchain technology for protected transactions, integration of voice-enabled services, and the expansion of decentralized finance (DeFi) applications.

For FinTech Project:- Seek Help From FinTech App Development Company!

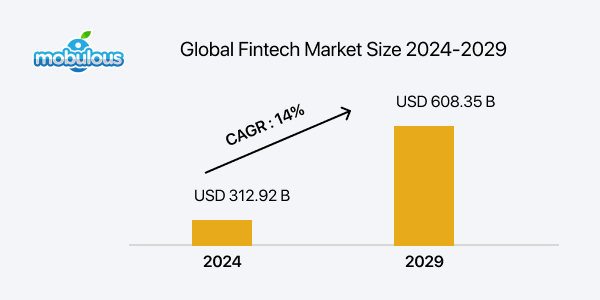

FinTech App Development Cost

According to the studies published by Mordor Intelligence, the Global FinTech market is envisioned to reach USD 608.35 Billion by 2029 at a CAGR of 14%. This growth is steered by several aspects like emerging digitalization, a strengthening need for financial inclusion, developments in technology like AI and Blockchain, etc.

Well, there is no such specified FinTech mobile app development cost as every firm has its individual purposes and conditions that impact the prevalent cost to build FinTech apps. Nevertheless, the FinTech app development costs rely on considerable factors such as its type, features, complexity, location of the FinTech app development company, and so on.

A custom FinTech app with basic features, including a protected and simple online transaction technique will cost you USD 12,000 to USD 30,000 and can be created within 3 to 4 months. In contrast, a FinTech app with a minimal user interface and functionality will cost you around USD 25,000 to USD 80,000. However, a highly complex app with advanced features may range from USD 60,000 to USD 300,000.

FinTech App Development Cost As Per Their Types

When talking about FinTech app development cost, we must understand it also varies as per the type of application you want to develop. Below is the type of Financial app and its approximate cost of development.

| Type of App | Cost of App Development (Rough Estimates) |

| Banking Apps | $20,000 to $100,000 |

| Lending Apps | $30,000 to $100,000 |

| Personal Finance Apps | $30,000 to $200,000 |

| Insurance Apps | $40,000 to $150,000 |

| Investment Apps | $45,000 to $120,000 |

1. Banking Apps

Banking applications are able to facilitate manual procedures by 45% and enrich customer retention swiftness by 30%. However, the cost to develop a FinTech app on the basis of its intricacy is about USD 20,000 to USD 100,000.

All financial solutions are offered online by the Internet or digital banking apps. From creating an account to applying for loans, everything can be accomplished through the Internet. Now, it is not obligatory to visit banks to get your work done, open your FinTech Banking app, and get activated.

2. Lending Apps

Lending apps facilitate customers to apply for loans quickly. The applications consist of smart approaches that ascertain identity credentials by leveraging Artificial Intelligence (AI) and Machine Learning (ML) technologies in order to deliver error-free results. Thus, these apps may vary from USD 30,000 to USD 100,000 and even more as per the intricacy of the app.

With Lending apps, it is seamless to anticipate income projections, demonstrate the worth of the collateral, foresee the alterations when technology is leveraged in the loan process, and analyze the borrower’s loan history precisely.

Also Read:- TechFin: What is TechFin?

3. Personal Finance Apps

Personal Finance applications help customers manage and oversee their finances seamlessly and hassle-free. They can keep track of their payments and outlays, make a budget, and ensure that they stick to it. Consequently, this app may cost you USD 30,000 to USD 200,000.

Personal Finance apps are among the best FinTech applications as they operate as respective bulletins for people to keep a trail of all their financial dealings. Hence, more and more businesses are coming forward to rule in Personal Finances.

4. Insurance Apps

Insurance apps in the FinTech industry are emerging at a rapid pace. An insurance carrier is able to create an application for agents or clients. The user is able to access policies across various lines with an insurance app that is already installed. This app will cost you roughly USD 40,000 to USD 150,000.

Well, insurance applications make interaction quick and simple. It offers quick claim processing to the user which leads to quick deal closure.

5. Investment Apps

Investment applications offer users opportunities to invest in multiple FinTech services. Businesses like mutual funds and others develop alike investment software customized to their particular user base. Accordingly, these apps may cost you nearly USD 45,000 to USD 120,000.

Some of the most noteworthy instances of investing solutions are cryptocurrency dealings, trading apps, and others. Additionally, other financial applications in this category include digital wallets and e-portals. Other applications for one-stop purchases including Amazon Pay are becoming more and more common.

Also Read:- TechFin vs Fintech: The Future of Finance is Here!

Breakdown of FinTech App Development Cost

Understanding the breakdown of FinTech app development costs is essential as it will help you comprehend FinTech development app estimate, budget, and resource allocation seamlessly and perfectly. Let’s move ahead and thoroughly learn this.

1. Development Phases and Timeline

The cost of development phases and timeline is roughly USD 30,000 to USD 300,000 based on the ideation, design, development, testing, and deployment. Each phase of the FinTech app development contributes to the prevalent expense of the project.

Let’s understand this in terms of percentage as well:

- Development stages and timelines may deviate depending on the intricacy and extent of the FinTech app development project.

- This accounts for approximately 40% to 50% of the total development cost.

- Ideating and creating the app may take 10% to 15% of the budget and the app development and testing phase will consume 30% to 35% of the overall cost.

2. Development Team Structure and Skillset

The cost of the team structure and skillset of the development team is around USD 15,000 to USD 45,000. The FinTech app development team incorporates project managers, designers, developers, and QA engineers. Hiring experienced developers ensures top-quality deliverables but it may enrich the expenses.

Let’s understand this in terms of percentage as well:

- The cost of the development team is a significant part of the budget.

- However, professional experts and skilled developers demand higher salaries.

- Therefore, this allocation generally accounts for 30% to 40% of the total FinTech app development costs.

3. Cost of Technology and Tools

The fee for most delinquent app development trends, technology, and tools for FinTech may vary from USD 5,000 to USD 15,000. Acquisition of development tools, licenses, and infrastructure (cloud hosting) incorporates a prevalent share of the budget. Choosing a cost-efficient and reliable technological solution for your FinTech app development is important.

Let’s understand this in terms of percentage as well:

- Technology and tools encircle costs as per the development environment, software licenses, infrastructure, and cloud services.

- This component typically constitutes 10% to 20% of the overall budget as per the selected technology stack and required potential.

4. Maintenance and Updates

Post-launch maintenance, updates, and support are enduring costs that may cost you nearly USD 20,000 to USD 40,000. Periodic updates guarantee security patches, more acceptable app performance, and compatibility with the most delinquent devices and operating systems.

Let’s understand this in terms of percentage as well:

- Post-launch maintenance and updates are crucial for app performance, compatibility, and security.

- The annual maintenance cost generally ranges from 20% to 30% of the overall FinTech app development cost.

- This ongoing investment ensures consistent enhancement and support for the FinTech application.

Factors Affecting FinTech App Development Cost

Calculating the FinTech app development cost is an easy task as it seems to be. There are multiple factors that affect a lot on the overall app development budget. Some of the factors affecting the FinTech development app estimate are explained below:

1. Scope and Complexity of the App

The complexity of features and functionalities including account management, payment processing, data analytics, and investment tracking significantly affects the FinTech app development cost. An extensive FinTech application with complex features will require more time and resources to develop the best FinTech apps.

2. Technology Stack and Infrastructure

Selecting the right technology stack such as programming languages, frameworks, cloud services, and databases impacts the scalability and efficiency of FinTech app development. Top-notch technologies may incur more heightened costs but deliver long-term benefits.

3. Design and User Experience (UX)

User-friendly design and intuitive interface are essential for FinTech applications. Financing or funding in UI/UX design guarantees seamless and hassle-free navigation that instantly impacts user adoption and retention swiftness.

4. Security Features and Compliance

Maintaining potent security measures and compliance with industry regulations like GDPR or PCI DSS adds to the FinTech app development cost due to its level of complexity. Security breaches and unlawful access to the app may have fatal consequences. Thus, making a security investment important.

5. Integration with Third-Party Services

Incorporating external services such as identity verification APIs, payment gateways, or financial data providers positively fluctuates the FinTech app development costs. However, leveraging established Financial services can expedite app development and improve app functionality.

6. Location of the FinTech App Development Team

The location of the FinTech app development company is another factor that affects the FinTech app development costs, depending on the hourly rate of the team. However, a FinTech app development expert in the USA charges more when compared with India. To know more about this, make sure to consider the below table carefully.

| Location | Hourly Rates of Developers (Rough Estimates) |

| India | USD 20 to USD 25 |

| Europe | USD 35 to USD 65 |

| North America | USD 40 to USD 70 |

| Africa | USD 35 to USD 50 |

| Latin America | USD 40 to USD 70 |

Also Read:- How to Choose the Best Company for Fintech Mobile App Development?

7. Time Required for FinTech App Development

The FinTech app development cost will be significantly influenced by the time of the project delivery. Increased teamwork is crucial for quick prototyping and FinTech app development. Thus, the team working on your project with a shorter delivery timeframe will incur a higher cost. Below is the total time estimation on the basis of the types of FinTech apps discussed above:

| App Type | Development Time (Rough Estimate) |

| Banking | 2,000 to 3,000 hours |

| Personal Finance | 1,300 to 2,600 hours |

| Lending | 1,900 to 2,400 hours |

| Investment | 1,700 to 2,000 hours |

| Insurance | 2,300 to 3,500 hours |

8. Advanced Technologies Used

Innovative technologies are transforming financial industries. Analyze leading-edge financial solutions such as Artificial Intelligence (AI), Blockchain, and IoT driving transformative shifts and enhancing efficiency across diverse sectors. These advanced technologies add up to the cost of FinTech app development.

Artificial Intelligence

Artificial Intelligence or AI is the most prevalent technology that affects the FinTech app development costs. AI allows user-centric chatbots, identification of fraudulent conduct, sophisticated financial planning, etc. Most financial apps usually depend on AI.

Blockchain

Blockchain is another one of the consequential technologies operated in FinTech app development that facilitates peer-to-peer payments. With the involvement of Blockchain technology, users will be able to get full transparency and will be able to finish their transactions within minutes.

Digital Analytics

Digital Analytics is another one of the most effective components of FinTech app development in order to assess consumer financial data and deliver crucial insights. Users will be able to keep track of their financial activity with this app.

With this technology, users are able to create transactional messages, reach savings objectives quickly, and monitor reports. Therefore the more complex the digital analytics will be included in the FinTech app, the more development costs will be there to build FinTech apps.

Tips to Reduce FinTech App Development Cost

Effective cost management strategies can optimize resources and maximize return on investment (ROI) for FinTech enterprises and startups. However, reducing FinTech app development costs requires strategic planning and optimization. Let’s learn some important tips to reduce the cost of FinTech app development.

1. Prioritize MVP Development

It is important to begin with a Minimum Viable Product (MVP) in order to validate core functionalities and seek user feedback. Concentrate on paramount features in order to reduce the FinTech app development costs.

2. Outsource Non-Core Tasks

Contemplate outsourcing non-core FinTech app development undertakings such as UI/UX design or QA testing to technical service providers or freelancers. This is able to facilitate the FinTech app development costs associated with keeping an in-house development squad.

3. Leverage Open-Source Technologies

Utilize open-source frameworks, tools, and libraries in order to accelerate FinTech app development and minimize the cost of development. Open-source solutions generally offer potent functionality and community support.

4. Implement Agile Methodologies

Make sure to adopt Agile development practices in order to encourage collaboration, iterative enhancements, and flexibility. Agile methodologies foster early detection of issues, minimizing rework and overall time of FinTech app development.

5. Optimize Cloud Infrastructure

Leverage cloud services for hosting, storage, and scalability. Cloud platforms offer cost-efficient solutions that enable users to pay only for resources used and scale as the FinTech app grows and advances.

6. Continuous Monitoring and Optimization

Enforce analytics tools in order to monitor app performance, resource utilization, and user behavior. Leverage data-driven insights in order to optimize features, reduce operational costs over time, and streamline processes.

Final Talk

FinTech app development costs differ on the basis of multiple factors such as its type, scope, technology, and regulatory considerations.

Strategic planning, effective resource distribution, and utilizing ingenious solutions are paramount to optimizing FinTech app development costs while providing unique user experiences.

As FinTech persists in reshaping the financial services landscape, careful investment in app development can unclose consequential possibilities for competitiveness and expansion.

FAQs — FinTech App Development Cost

Q. How much does it cost to develop a FinTech app?

Ans. A basic features app may cost you around USD 12,000 to USD 30,000. In contrast, a FinTech app with a minimal user interface and functionality will cost you around USD 25,000 to USD 80,000. However, a highly complex app with advanced features may range from USD 60,000 to USD 300,000.

Q. How long does it take to build a FinTech app?

Ans. A basic FinTech app with simple features takes 2 to 4 months to get developed. In contrast, an intermediate app with average features takes 5 to 11 months to complete. However, a complex app with advanced features takes 12 to 18 months and even more to develop.

Q. What is the retention rate for the FinTech app?

Ans. The average retention rate in the FinTech vertical is around:

- 1 Day: 23%

-

- 7 Days: 16%

- 30 Days: 11%

Q. Is FinTech cost-effective?

Ans. FinTech companies are usually more ingenious, smart, fast, and cost-effective whereas conventional banks are more established and provide a plethora of financial services.

Q. Does FinTech use AI?

Ans. Financial service providers have made the security of their clients their main priority, hence they leverage AI in their FinTech companies. Financial institutions are enforcing AI-based systems in record numbers, with more than USD 217 Billion spent on Artificial Intelligence apps that assist users to prevent fraud and analyze any risks associated with it.

Q. Are FinTech companies profitable?

Ans. Several apps in the Financial Services industry are known as FinTech giants, including Razopay, Zerodha, Paytm, Billdesk, Pine Labs, etc which have been extremely profitable for quite some while now.